The flexible printed circuit (FPC) industry is riding a wave of innovation, driven by two powerhouse sectors: smartphones and automotive electronics. These markets demand ever-smaller, more flexible, and more reliable circuits—and FPCs are rising to the challenge. From foldable phone hinges to electric vehicle (EV) battery management systems, FPCs are the unsung heroes enabling the next generation of technology. Let’s explore how these two industries are reshaping the FPC landscape and what it means for manufacturers, engineers, and consumers.

Smartphones: Pushing FPCs to the Limits of Miniaturization

Smartphones are a relentless driver of FPC innovation. As consumers crave slimmer designs, larger screens, and more features—from 5G connectivity to under-display cameras—FPCs have become the backbone of device architecture. Here’s why they’re indispensable:

1. Enabling Foldable Revolution

Foldable phones (like Samsung’s Galaxy Z series or Motorola’s Razr) are the ultimate test for FPCs. The hinge mechanism, which bends hundreds of thousands of times, relies on ultra-durable FPCs that can withstand:

- Extreme flexure: FPCs in foldable hinges use rolled annealed (RA) copper (18μm–35μm thick) and polyimide (PI) substrates (12μm–25μm) to survive 200,000+ 180° bends without cracking.

- Space constraints: These FPCs must fit into gaps as narrow as 0.3mm, requiring precision etching of traces as thin as 0.05mm to carry power and data between the folded screens.

Global shipments of foldable phones are projected to hit 100 million by 2027, according to Counterpoint Research—each unit containing 5–8 specialized FPCs, a 3x increase over traditional smartphones.

2. 5G and High-Speed Data Demands

5G smartphones require FPCs that transmit data at multi-gigabit speeds without signal loss. Key advancements include:

- Low-loss materials: Liquid crystal polymer (LCP) substrates, with a dielectric constant (εr) of 2.9, minimize signal attenuation at 28GHz and 39GHz (mmWave 5G bands).

- Impedance control: Tight tolerance (±5Ω) 50Ω FPCs ensure reliable connectivity between 5G modems and antennas, even in the cramped space of a phone’s frame.

Apple’s iPhone 15 Pro, for example, uses LCP-based FPCs for its 5G antenna modules, reducing signal loss by 30% compared to previous generations.

3. Camera and Sensor Integration

Modern smartphones pack 3–5 cameras, plus sensors for face ID, gyroscopes, and more. FPCs connect these components with:

- Ultra-thin designs: 0.08mm–0.1mm thick FPCs snake through tight gaps between camera lenses and phone bodies.

- High-flex materials: Adhesiveless PI-copper laminates prevent delamination, ensuring stable data flow from image sensors to processors.

Automotive Electronics: FPCs Powering the EV and ADAS Revolution

While smartphones drive miniaturization, automotive electronics demand FPCs that thrive in harsh environments. As cars go electric and autonomous, FPCs are replacing rigid PCBs in critical systems, offering lighter weight, greater design flexibility, and improved reliability.

1. Electric Vehicle (EV) Battery Management Systems (BMS)

EV batteries rely on FPCs to monitor and balance hundreds of cells. These FPCs must survive:

- Extreme temperatures: -40°C to 125°C, requiring PI substrates and high-temperature adhesives (Tg ≥ 150°C).

- High currents: Thick copper traces (35μm–70μm) carry 100A+ currents between battery cells and BMS controllers.

- Vibration resistance: Adhesiveless lamination and reinforced coverlays prevent delamination in moving vehicles.

Tesla’s 4680 battery packs, for instance, use custom FPCs to reduce wiring weight by 50% compared to traditional harnesses, boosting EV range by 5–8%.

2. Advanced Driver-Assistance Systems (ADAS)

ADAS—including radar, LiDAR, and camera systems—depends on FPCs for precise signal transmission:

- High-frequency performance: FPCs with LCP or modified PI substrates handle 77GHz radar signals with minimal loss, critical for collision avoidance.

- Compact design: FPCs wrap around curved surfaces (e.g., behind bumpers or in side mirrors) to fit LiDAR sensors, which require 360° coverage.

- EMI shielding: Copper foil shielding on FPCs prevents interference between ADAS components and the car’s electrical system.

A study by Yole Développement predicts ADAS FPC demand will grow at 18% CAGR through 2028, driven by the shift to Level 3+ autonomy.

3. In-Car Infotainment and Connectivity

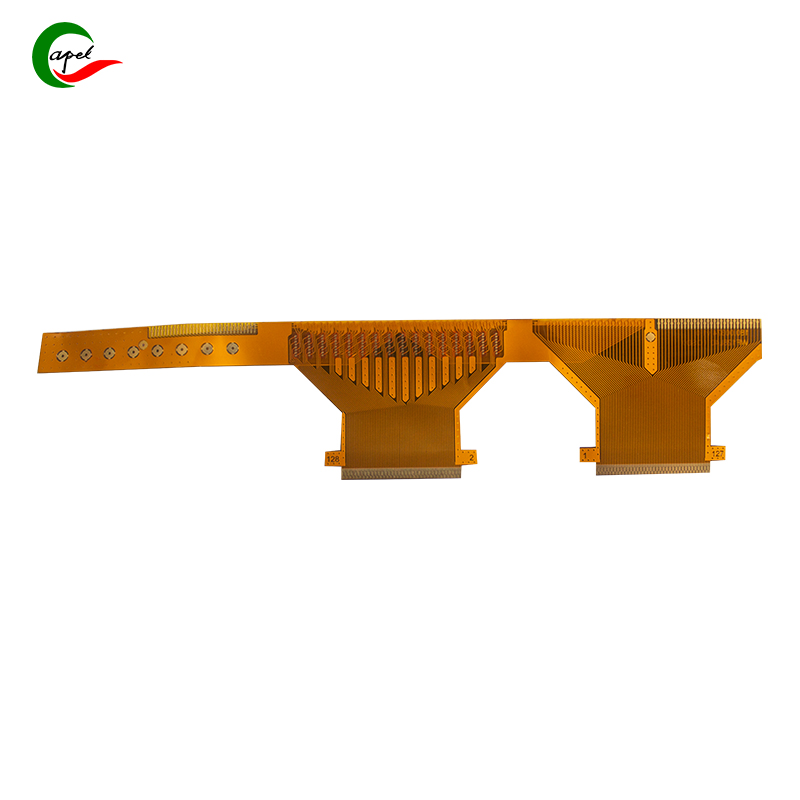

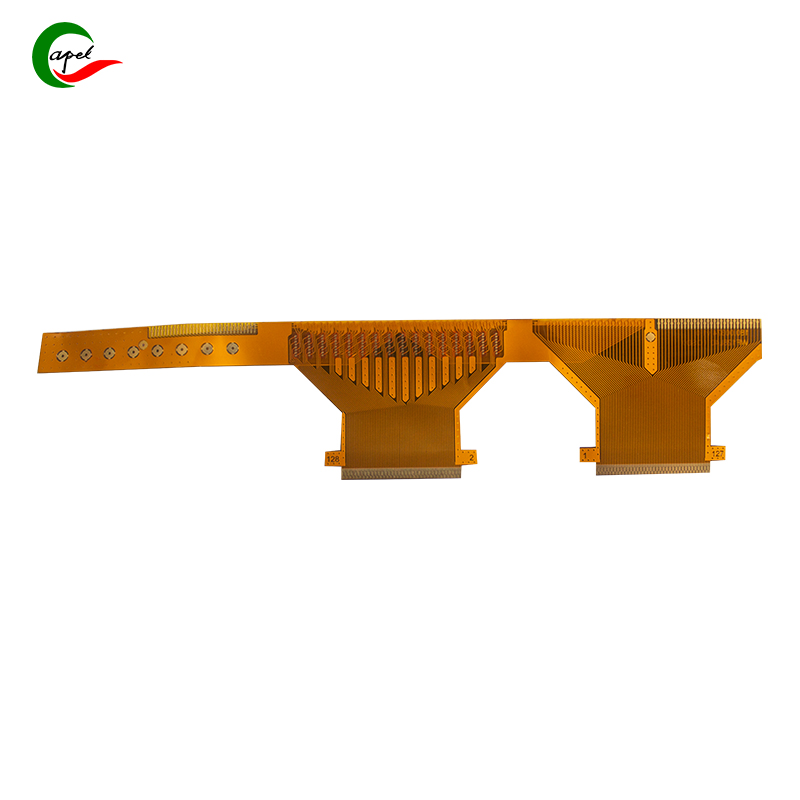

Modern cars are becoming "rolling smartphones," with touchscreens, wireless charging, and 5G connectivity. FPCs enable:

- Curved displays: Ultra-thin (0.05mm–0.08mm) FPCs bend to match the contours of dashboard screens, supporting sizes up to 17 inches.

- High-flex life: FPCs in fold-down screens (e.g., in SUV rear seats) survive 10,000+ open/close cycles with RA copper and PI coverlays.

Key Trends Shaping FPC Innovation in Both Sectors

While smartphones and automotive electronics have distinct needs, they’re driving shared advancements in FPC technology:

- Material innovation: LCP and low-loss PI substrates are gaining ground in both industries for high-frequency performance.

- Sustainability: Manufacturers are developing recyclable PI and lead-free adhesives to meet EU and U.S. environmental regulations.

- Automation: AI-driven inspection (AOI with 5μm resolution) and digital twin simulations are reducing defects in high-volume production.

The Competitive Landscape: Who’s Leading the Charge?

Asian manufacturers (Japan’s Nitto Denko, South Korea’s SEMCO) dominate the FPC market, but U.S. players are gaining ground:

- Flex (formerly Flextronics): Supplies FPCs for Ford’s EV batteries and Apple’s iPhones, emphasizing localized production in Mexico and the U.S.

- TTM Technologies: Focuses on automotive FPCs, with a new plant in Texas to serve Tesla and GM.

The race is on to meet soaring demand: Global FPC market revenue is expected to hit $35 billion by 2026, with smartphones and automotive electronics accounting for 70% of growth (Grand View Research).

Conclusion: FPCs as the Glue of Next-Gen Technology

Smartphones and automotive electronics aren’t just driving FPC demand—they’re redefining what FPCs can do. In phones, they enable feats of miniaturization and flexibility; in cars, they survive extremes to power safety and efficiency. As these industries evolve, FPCs will remain at the center, adapting to new challenges and enabling innovations we haven’t yet imagined.

For engineers and manufacturers, the message is clear: Invest in FPC expertise, and you’ll be at the forefront of two of the most transformative tech revolutions of our time.

Founded in 2009, our company has deep roots in the production of various circuit boards. We are dedicated to laying a solid electronic foundation and providing key support for the development of diverse industries.

Whether you are engaged in electronic manufacturing, smart device R&D, or any other field with circuit board needs, feel free to reach out to us via email at sales06@kbefpc.com. We look forward to addressing your inquiries, customizing solutions, and sincerely invite partners from all sectors to consult and collaborate, exploring new possibilities in the industry together.